A technology consultant living in Washington, DC and FI/RE-ing in 8 years with $760k

/Occupation: Technology Consultant

Industry: Financial Services

Location: Washington, DC

Age: 27

Salary: 95K/year with bonus averaging around 1.2K

Ethnicity: White

Education: Masters

Current financial situation: Single, living with two roommates

What was your first job? Why did you get it? How much did you get paid?

Babysitting, I was getting paid $16/hr and loved working with kids

Growing up how did you learn about personal finance? Was money talked about openly? How did it make you feel?

One reason I've been motived to reach FI is that my parents really didn't teach me much about personal finance. I once asked my dad how to make a budget, and he told me he didn't know because they never had one. I personally don't feel my parents make the best choices with their money (or at least, they do not make the choices I would).

What was the moment or event that made you realize you needed to start getting your money together?

Probably at some point later in high school; I knew by then that I did not want to worry about money as often as my parents did (or keeping up with appearances), so I chose to get a business degree rather than to pursue and English or art degree in order to obtain a more stable, secure income post-college.

Let’s Talk Money

Current Net Worth: $238,175

HSA: $4,275

Investments: $89,400

Vested 401k: $78,000 (about $5,000 unvested in 401k)

Pension: $6,700

High Yield Savings: $20,000

Checking: $700

Roth IRA: $39,100

Debt: No debt, but ~$5,000 of my 401k is unvested, so if I leave my job before the vesting date, I will have to give that amount back. The ~$5,000 includes contributions and earnings from my 401k match.

Expenses:

Rent: $952

Internet & Phone: $0 (covered by my employer)

Electric: ~$40

Water & Trash: $120 every 3 months

Spotify: $9.99

Libro.FM: $14.99

Club Membership: $12

Donations: $52

Computer & Phone Security Software: $39.99/year

Savings Rate: 59% after tax

Investing strategy: Max out all tax-efficient accounts (HSA, IRA, 401k) and invest the rest in my brokerage account up to 55%. Last year I saved/invested more than normal because I wasn't traveling, but this year I decided to begin a sinking fund where I will put 5% of my paycheck each month to save for large purchases/luxury items (future trips, spa visits, art classes, etc.).

Your FI/RE Story

FI/RE number: FI : $762,000 ; Fat FI $1,070,000

FI/RE type: My Fat FI number is less than $100,000/yr, but I really only spend about $25,000 of my pay check per year and do not feel limited in anyway, so I felt that $40,000/year was a realistic FAT FI number for me. I'm also planning to eventually move to a lower COL area once I retire (DC is considered VHCOL).

Years until FI/RE: ~8.4, but I may work a little longer to reach my FAT FI number

FI/RE location: Ideally Richmond or Charlottesville, but I'm open to other areas. I've considered the Great Lakes region due to global warming, as I believe that area will be best prepared, and current COL expenses there are so cheap compared to the rest of the country.

How did you first hear about FI/RE?

My ex-boyfriend, he sucked and gave terrible FI/RE advice, but at least I gained knowledge of this movement from that relationship and was able to do my own research to make better choices

Why do you want to reach Financial Independence/Retire Early? What keeps you motivated on this long journey?

I have a few friends who are significantly older than I am, and they've all had a story about a friend who lost his/her/their job after age 40 and was unable to find a new one. To me, achieving FI would provide security, should this situation ever happen to me, or should I face unexpected retirement. Additionally, I like the idea of FI/RE because I believe it will give me more time to pursue my many hobbies (reading, hiking, volunteering), most of which are difficult to fit in during the week while I have a full time job.

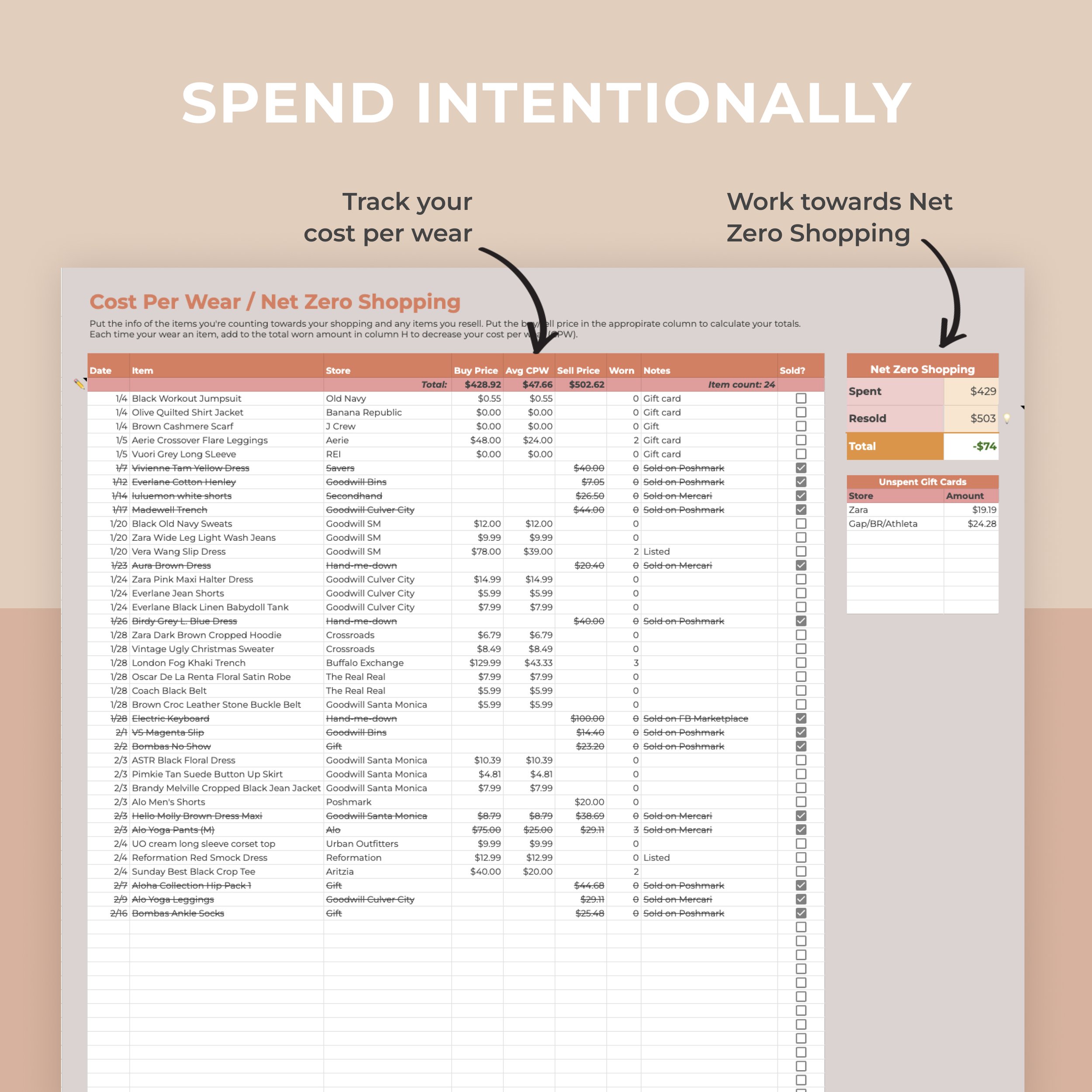

In what ways have you cut back your spending? In what ways have you started mindfully spending more?

I was already naturally frugal before finding out about FI/RE, but I definitely contribute a larger % of my income to my retirement accounts than before. Additionally, I think I'm a pretty mindful spender by nature, but typically I don't buy anything unless my mind keeps going back to it. For example, if I go into a store and look at their clothes, I will never buy an item the first time I see it. Instead, I'll typically leave and wait to see if I develop a craving for that item, where I find myself thinking about the item a lot. Then I'll come back for it. I do the same thing with restaurant food; if I find I'm still craving pasta or a burrito after a few days, I'll go ahead and treat myself.

What do friends and family have to say when you tell them your plan to achieve FI/RE? Are they supportive?

FI/RE isn't something I talk about with a lot of people. I try not to talk about money with my friends, as most work as artists, researchers, or academics, but there's definitely an unspoken understanding that I am making more than they are. No one seems bitter about this though.

My parents think my goals are admirable but unrealistic if I plan to have a house or children some day (I have already decided that I don't want either if I have to compromise the security of FI, but my parents think I will change my mind).

Are you doing anything to achieve FI/RE faster?

I definitely do not need to live with roommates and could afford my own place if I wanted, but one-bedroom apartments in this area cost an average of $2,200/month (at the low end, they are still $1,700/month). By living with roommates, I am able to put $1,000/month towards savings and investments. Additionally, I take advantage of all the benefits my company offers.

What does retiring early (or financial independence) mean to you? What will you do once you FI/RE?

Write a book, go on long multi-day hikes, volunteer, get a dog, cook more, workout more, relax.

FI/RE Advice

Any advice you'd give to someone who wants to pursue FI/RE, especially if it seemed hard or unattainable?

Really think about what you actually need to be happy. Realize that material things, like hardwoods floors and marble countertops, or that pair of $100 sunglasses you bought for yourself in the moment may spark joy initially, but won't in the long term. Think about what provides you happiness again and again.

What is the biggest thing you learned about money on this journey?

It's important to be thoughtful and purposeful with your money.

Have you made any money mistakes or learned any lessons on the way that you wish you knew before?

Not maxing out my 401K each year, and believing there was such a thing as putting too much money in your 401K.

What are your favorite FI/RE resources that you'd recommend to someone just getting started?

Quit Like a Millionaire is a great book! The author really simplifies the process, and does so in a funny way.

Disclosure: Some links are affiliate links, meaning, at no additional cost to you, I may earn some compensation. All opinions are 100% my own! I truly appreciate you and your support. :)